Nafta Commercial Invoice

TxDMV has a program for licensing commercial vehicles engaged in interstate operations. The invoice should also be clearly marked pro forma invoice.

New U S Mexico Canada Agreement Usmca Fedex

The form may be prepared by the supplier importer.

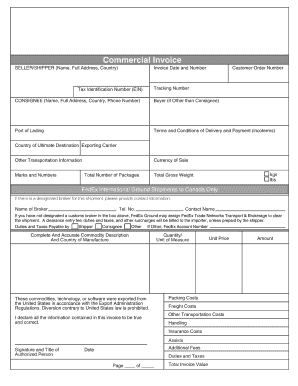

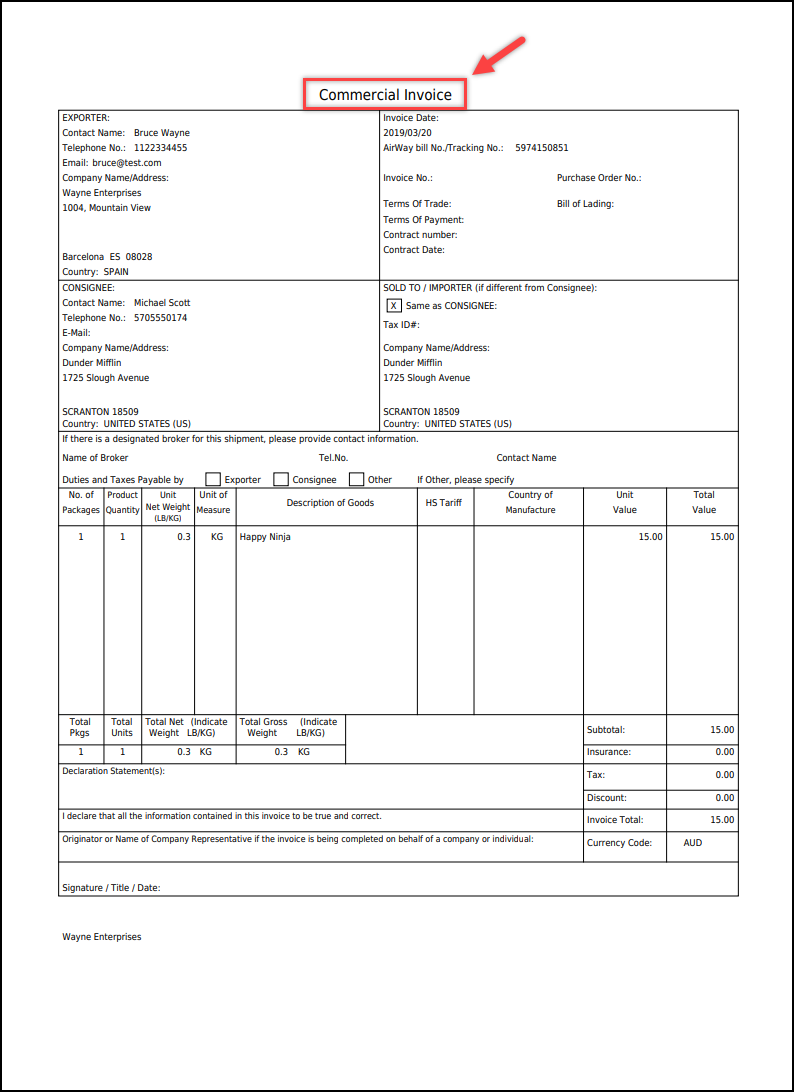

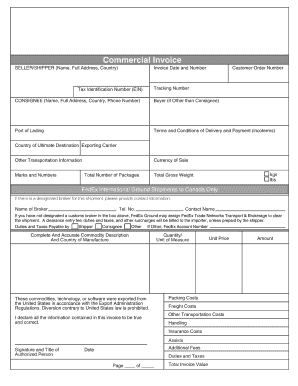

. Step 1 Go to This Webpage and print. Commercial Invoice The commercial invoice functions as a bill of sale between the seller and the buyer. This information may be provided on an invoice or any other document.

Once your international buyer accepts the terms on the proforma invoice and places their order you need to prepare your goods for shipping including the paperwork required to accompany the goods. A proforma invoice looks a lot like a commercial invoice and if you complete it correctly they will be very similar indeed. Download the FedEx commercial invoice template to track and verify international shipments made with FedEx.

When your international shipments include items other than documents typically one original and two copies of a commercial invoice are required along with the UPS shipping document. The buyer and seller in the transaction. Provide a full description of each good.

One copy of the invoice with the following declaration. Its the primary document used by most foreign customs agencies for import control valuation and duty determination. PACKAGE MARKS Record in this field and on each package number for example 1 of 73 of 7 shippers company name country of origin eg Made in USA destination port of entry package weight in kilograms package size length x width x height and shippers control number optional.

If not known indicate another unique. When you are sending multiple packages to the same recipient only the lead package1 requires a shipping document2 and three copies of the commercial invoice3. Canada Customs requires certain information to be provided.

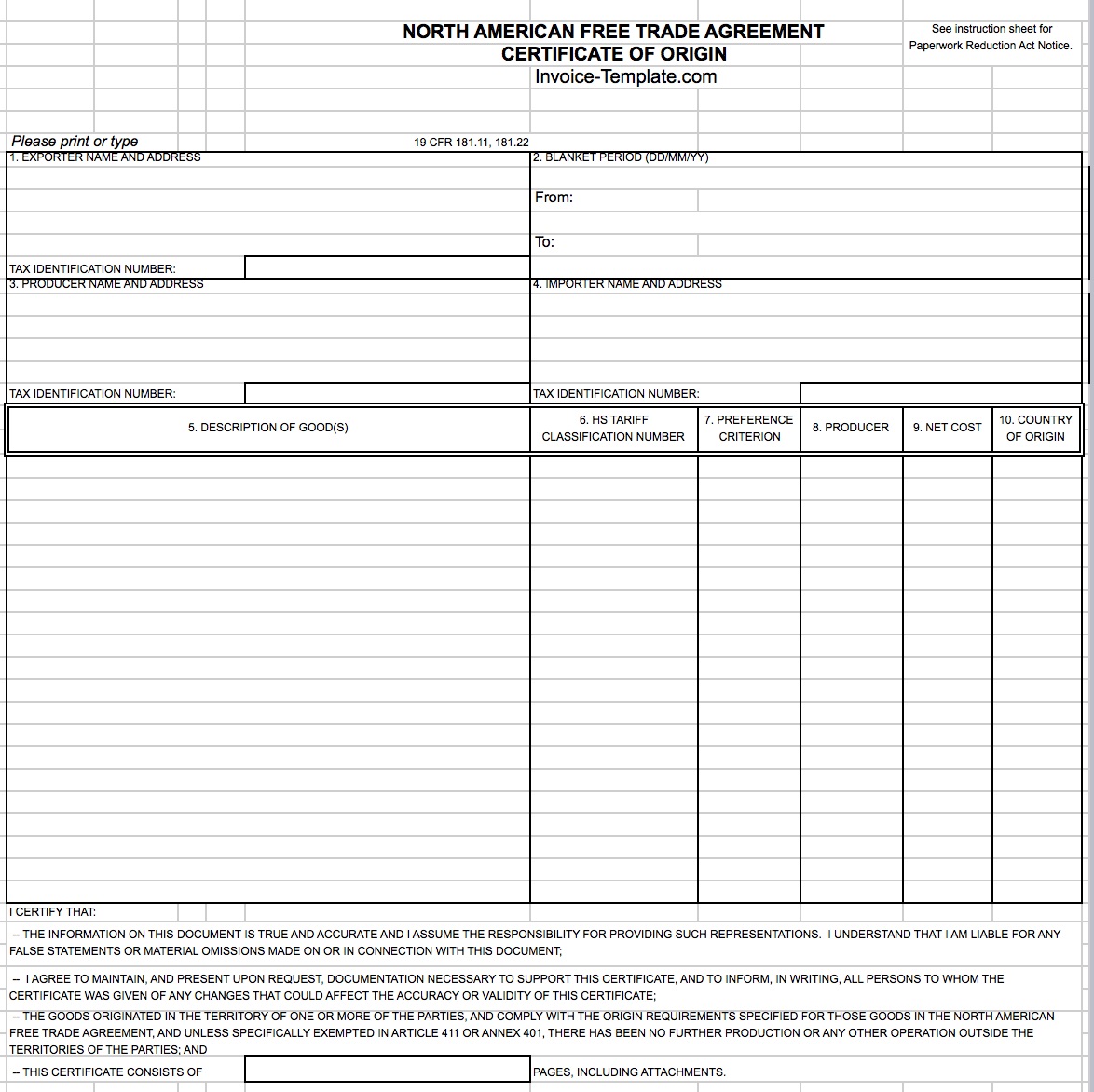

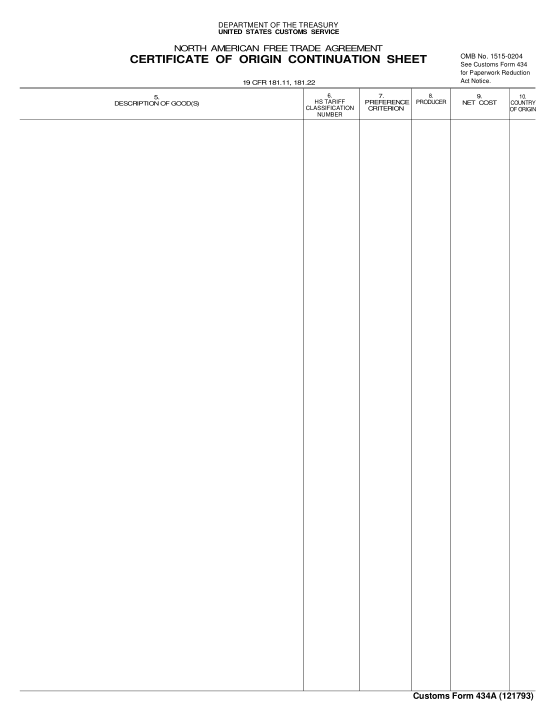

This allows recipients and couriers to verify that the shipment is correct and keep accurate records. Fee that is applicable per certificate. This means you do not have to fill out the formal Certificate of Origin.

TOTAL COMMERCIAL VALUE Total value of the invoice. NAFTA will probably soon be replaced by the US-Mexico-Canada USMCA Free Trade Agreement. The USMCA certificate of origin replaced the NAFTA certificate of origin on July 1 2020.

Packing list in duplicate for the concerned invoice. For FedEx International Ground shipments always use the Commercial Invoice for FedEx Ground. Provide a full description of each good.

One original and two copies are required for all international non-document shipments. The Harmonized System classification of those goods. The Commercial Invoice is required for all international commodity shipments and serves as the foundation for all other international shipping documents.

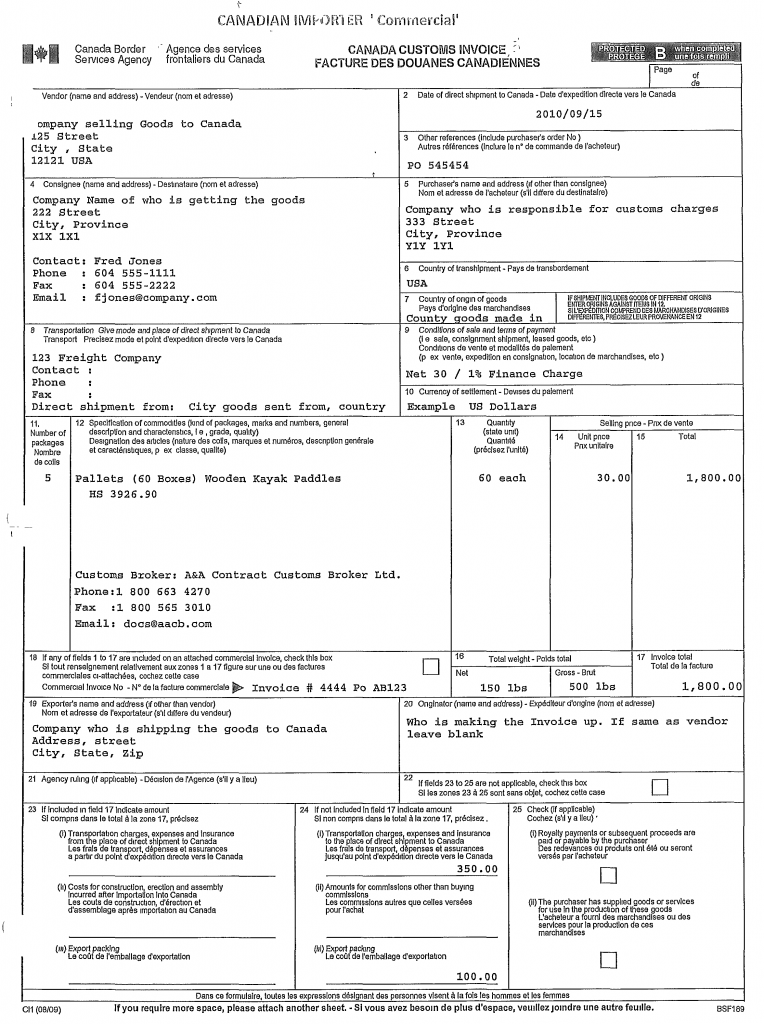

A proforma invoice specifies the following. Customs providing one will smooth your shipments path across the border. This form is used to provide the necessary information to customs for all Canada-bound commercial goods.

As of January 1 2008 all tariffs and quotas were eliminated on US. We hereby declare that the goods mentioned in this invoice are of Indian Origin and manufacture Nine copies of the Certificate of Origin. The description should be sufficient to relate it to the invoice description and to the Harmonized System HS description of the good.

OrAfter manufacture or production in. The information must describe the originating good in sufficient detail to enable its identification and meet the requirements as set out in the Uniform Regulations. The invoice identifies the product being shipped country of origin a full description of the product its intended use and commercial value.

You should also include a NAFTA Certificate of Origin. Procedure for Issuing Certificates of Origin. The description should be sufficient to relate it to the invoice description and to the Harmonized System HS description of the good.

A Canada Customs Invoice CCI or Commercial Invoice is required for every commercial entry into Canada. Per USMCA Annex 5-A the data elements are. Foreign buyers require this document in order to prove ownership and arrange for payment.

Is a Canadian owned company leading the ever changing transportation industry since it was incorporated in June of 1989. The statement should be handwritten. The payment term of the sale which would typically.

A detailed description of the goods. If you operate interstate you may. Always include a copy of your Commercial Invoice INSIDE as well as OUTSIDE the package.

A NAFTA Certificate of Origin is not required for the commercial importation of a good valued at less than US1000. NotesExcept for goods subject to NAFTA drawback this subchapter shall not apply to any article exportedFrom continuous customs custody with remission abatement or refund of dutyWith benefit of drawbackTo comply with any law of the United States or regulation of any Federal agency requiring exportation. You can use a Statement of Origin from the exporter or producer certifying that your goods originate within a NAFTA CIFTA CCFTA or CCRFTA territory.

Pro forma invoices are not used for payment purposes. A commercial invoice which indicates the buyer seller country of origin price paid or payable and a detailed description of the goods. Apportioned registration also known as the International Registration Plan IRP lets you obtain registration credentials in one jurisdiction giving you the freedom of interstate travel without the inconvenience and expense of purchasing trip permits.

If the Certificate covers a single shipment of a good include the invoice number as shown on the commercial invoice. The Commercial Invoice for FedEx Express is only appropriate for international FedEx Express shipments eg FedEx International Priority. The shipment must have its commercial invoice with it.

However for goods to qualify for NAFTA preferential duties the invoice accompanying the commercial importation must include a statement certifying that they qualify as originating goods under the NAFTA rules of origin. Exports to Mexico and Canada under the North American Free Trade. While this is not legally required by US.

If the certificate covers a single shipment of a good ie it is not a blanket certificate include the invoice number as shown on the commercial invoice. We Are Leading the Transportation Industry. The North American Free Trade Agreement NAFTA which was enacted in 1994 and created a free trade zone for Mexico Canada and the United States is the most important feature in the US-Mexico bilateral commercial relationship.

How to Print Online. In addition to the 15 items just listed a pro forma invoice should include two statementsone that certifies that the pro forma invoice is true and correct and another that indicates the country of origin of the goods. Documentation for informal entry is less stringent than it is for formal entry.

Importer Exporter or Producer Certification of Origin. The invoice will clearly identify the shipper and recipient in addition to the goods being shipped.

21 Steps To A Completed Canada Customs Invoice A A

Free General Customs Nafta Commercial Invoice Template Pdf Word Excel

Commercial Invoice Veritas Global Transportation Inc

Free General Customs Nafta Commercial Invoice Template Pdf Word Excel

What Is A Commercial Invoice Meaning Template How To Fill It

Fillable Online Fedex Commercial Invoice Canada Pdf Fillable Form Fax Email Print Pdffiller

Shipping With Fedex Under Cusma Fedex Canada

Commercial Invoice Sample Privacy Shield

General Customs Nafta Commercial Invoice Template Word Excel Pdf Free Download Free Pdf Books